Contract Templates > Revenue Sharing Agreement

Revenue Sharing Agreement

If you’re entering into a new business partnership it’s important to have clear and concise rules around what to do with revenue. We’ve taken the headache out of putting together a strong revenue sharing agreement. Our free and fillable template is easily customizable and already contains the legal language required. Come use our simple framework for creating, delivering, and getting your revenue sharing agreement signed quickly. Customize and deliver in minutes, then get it signed with built-in eSignature.

Best proposal software ever!

I’ve tried soooo many proposal softwares and I’ll never try another one after Proposable. It’s so easy to use and it looks good, which all the others don’t.

Smart, reliable, and constantly improving.

Proposable just works. I can make visually interesting sales presentations, dynamically insert content, and execute agreements. Proposable powers our entire sales process.

Wow Your Customers

Blow your clients away with a beautiful proposal that stands out above the rest. Add video and rich-media directly into your proposal pages for a more immersive sales presentation that’s sure to make an impact.

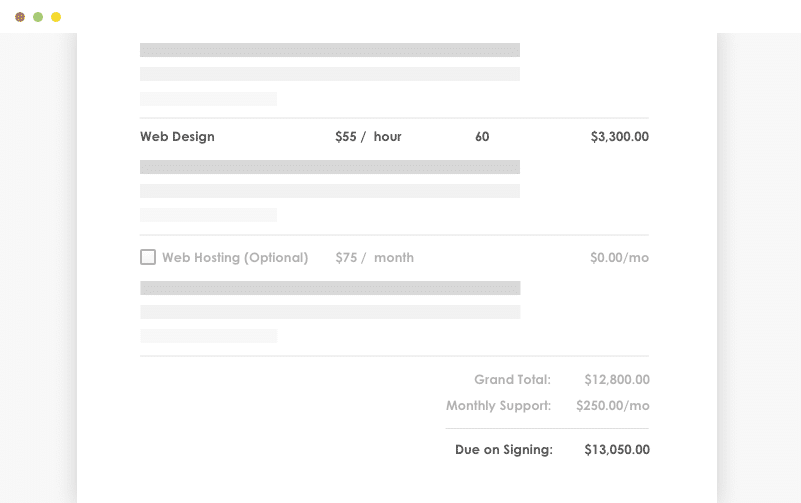

Set Your Prices

Quickly build quotes, bids, and estimates with our flexible estimate block. With optional line-items, optional quantities, taxes, discounts and more, you can quickly represent your products and services in a polished and readable format. Organize all your products and services in the Pricing Catalog for instant recall.

Work With Teammates

Easily collaborate with teammates on proposals. Mention team members to bring them into a proposal, or re-assign ownership when you need to handoff the proposal to another teammate.

Get It Signed

Close the deal faster with integrated e-Signatures. Place signatures, initials, and text field elements throughout your proposal wherever you need prospects to take action and your prospect is guided through a quick acceptance workflow to complete their acceptance. Counter-signing support is also included.

Track Everything

Ever wonder what happens to your proposal after you hit “send”? See detailed analytics and measure how each recipient is interacting with your sales material. Turn on real-time text or email notifications for proposal views and other key events.

Get Your Time Back

Save time and headaches by skipping the painful copy/paste and find & replace on all new proposals for your prospects and customers. Simplify your new proposal workflow to just a few clicks and go from spending hours on customizing new proposals to just minutes.

Edit & Deliver This Template

Related Templates:

Business partnerships are often seen as rather complex and risky. The United States has had multiple reforms in its revenue, productions, profit, and grants models. Partnering companies usually go for a model called revenue sharing.

In the simplest form, this means the splitting of all means of revenue amongst the companies involved.

The revenue has multiple dimensions and determining factors. It’s also influenced by various government policies in both the public and private sectors.

A categorical grant example or an unfunded mandate example makes an excellent case study of exactly how tricky the accounting for revenue sharing arrangements is.

While the revenue sharing business model has its grey areas and loopholes, it’s also quite beneficial in many ways.

There are business partnerships and corporate partnerships that have proved why revenue sharing is a better practice than other models. For instance, when the revenue is distributed, it includes expenses of production, labor, profit, losses, etc.

This combined splitting makes it easier for partner companies or individual businesses to digest their revenue share. Payment cut downs, which are a part of the disadvantages of a production sharing agreement, aren’t so frequent in revenue sharing. However, crafting agreements is a crucial task that often needs legal help and written documents that affirm the involvement of the partners.

A wholesale real estate joint venture agreement, for example, has tons of inclusions in it. It’ll include information about management contributions, capital contributions, taxation details, installments, profit sharing, accounting details, and a lot more. In the revenue sharing model, model, having written agreements is perhaps the most certain way to make sure everything goes right.

On the surface, revenue sharing seems rather superficial and bothersome. However, in reality, it’s pretty comprehensive and helps to simplify the responsibilities of different parties in the agreement.

Revenue Sharing Example

Let’s take a deeper look into what exactly revenue sharing is and how it works in the real world.

In the United States, the revenue sharing Nixon model, signed by Richard Nixon in 1974, was a landmark. This model was originated by the economist Walter Heller. According to this revenue sharing example, the primary source of revenue was the US’s taxation system.

The taxes that the federal government collects are meant to be spent on public and state welfare. The federal system distributes this revenue amongst the state-level and local governments, based on their requirements and plans. The advantages of revenue sharing in Richard Nixon’s model are pretty impressive.

The model allows local participation of the public, lesser discrimination, better decisions, and a smooth flow of capital in revenue sharing investments. Let’s look at the hotel revenue sharing agreement and the revenue sharing model in real estate. While both entities come under the category of property and give out property taxes, the former is also a part of the service industry.

Therefore, the revenue sharing lease agreement and other monetary or workforce distribution parameters vary for both of these. For a change, let us have a look at a revenue-sharing model in software form.

If we talk about internet marketing, we see the prevalent way of revenue distribution between the marketer and the client depends on the cost per sale (CPS) formula. This also requires the involved parties to determine how effective and comprehensive a certain marketing strategy is going to be.

Paying for advertisements, web-hosting plans, affiliate marketing, etc. also have an impact on revenue generation and sharing. In short, revenue sharing in each field can vary due to different parameters. Above all, each contribution is detrimental to the way the revenue is shared.

Incentives

At the end of the day, revenue sharing isn’t totally centered on the investors and owners in a joint venture profit-sharing agreement—the grassroots employees who work tirelessly to make the revenue as rewarding and lasting as possible. In return, employees rightfully expect and deserve just incentives in the revenue sharing model.

Employees working in restaurant profit-sharing agreements or real estate profit-sharing agreements usually sign the employee profit-sharing agreement. While you figure out how to calculate revenue share, each profit-sharing partner should agree on the decided share for employees. A partnership profit-sharing example where employee incentives are strong had the best chances for the highest revenues.

Bonuses, vacations, medical insurance, loans, etc. provide strong moral encouragement and build employee trust in the partnership. The employees also gain a sense of self-worth and have better workplace mental hygiene. They stick to their commitments and value the perspective of the investors and employers.

In a sheer capitalistic society, employee incentives are among the best reasons to establish revenue sharing models. The employees are more responsible for the losses and take company interests seriously. In return, this helps in generating better long-term profits.

Profit-Sharing Template

Profit-sharing is a bit different from the revenue sharing for employees. Profit-sharing is an incentivized compensation given to deserving retired employees. Following this model, a certain percentage of a company’s total profits are set aside by the investors to distribute between the employees. The profit-sharing agreement between a doctor and a hospital or a software development profit-sharing agreement are some common examples.

Profit-sharing is a simple process and enriches revenue generation in any workplace. A profit-sharing proposal can be drawn on a profit-sharing plan template. The profit-sharing clause needs to be decided through the partnership profit sharing ratio. A simple profit sharing agreement document contains the commercial lease with profit sharing and the profit and loss agreement sample.

Industries ranging from restaurants to online writers to car mechanics each have their standard profit-sharing plan template. Doctors, nurses, pharmaceuticals, the food industry, tech and IT are some more examples of industries where profit sharing is a practice. The profit-based incentives usually are accounted for on a profit-sharing spreadsheet template. This profit-sharing plan keeps an eye on the individual performance of each employee and decides their incentives.

Essentially, profit sharing has a direct effect on the employees and can morally be quite a motivation. While revenue sharing is better understood between different partners in an agreement, profit sharing is more suitable in employee-employer relationships.

In a profit-sharing plan, a company first determines the total employees’ compensation in monetary terms. Each employee is then allocated a part of the company’s profits by dividing the profits by the employee’s annual compensation. This figure is multiplied by the total amount of the profits bring shared by the company. This calculation is done in order to keep each incentivized compensation in a fair balance with the employee’s performance.